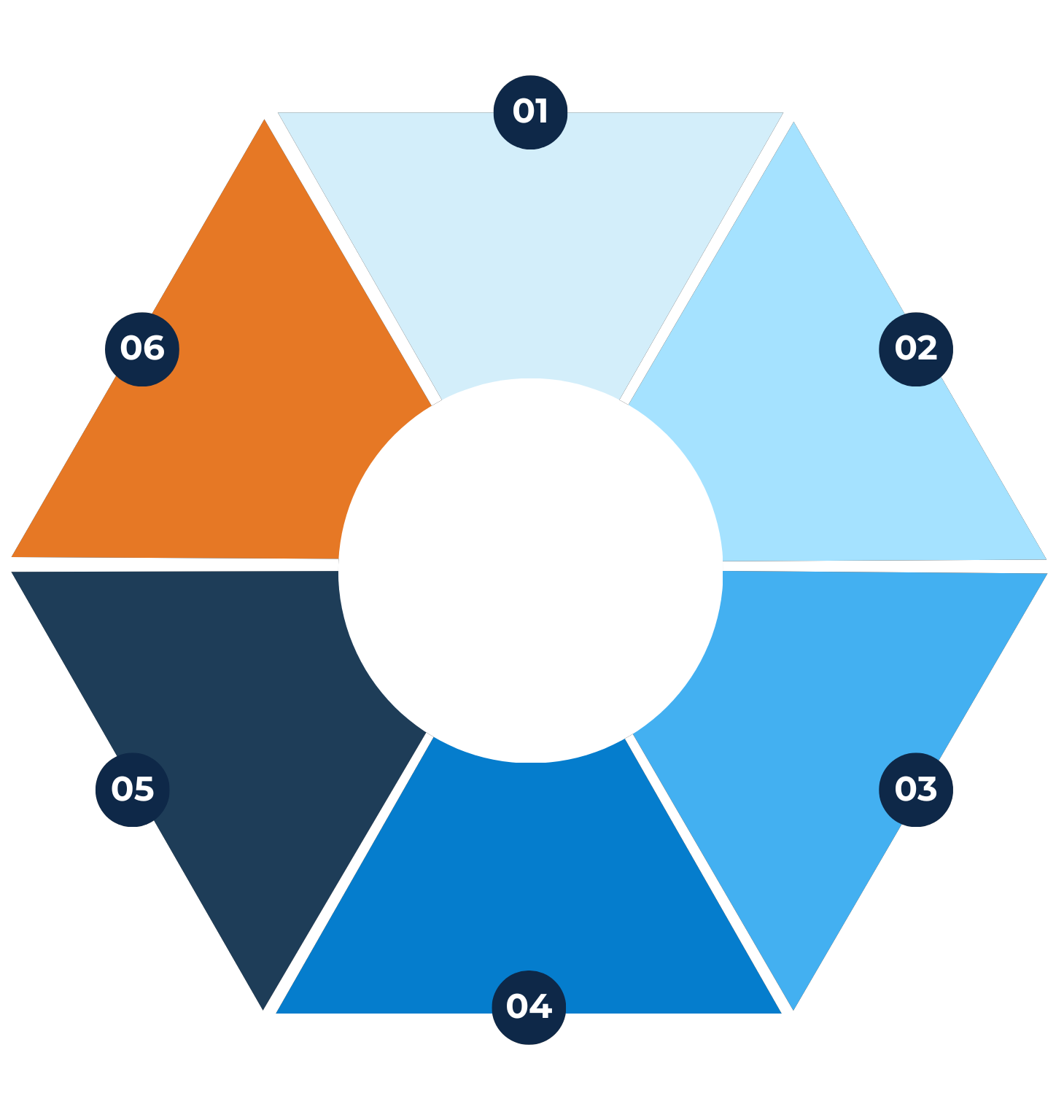

Your Income Plan devises strategies designed to improve your cash flow and stretch your dollar further through tax effective strategies and the efficient use of your income.

The resulting surplus funds are then used to create wealth.

Your Investment Plan explores different options you have for investing your surplus funds. The benefits of these options will change as market conditions and other variables fluctuate.

We help you determine the risks and rewards of various appropriate strategies to enable you to make informed investment choices.

Your Debt Plan looks at ways to improve your current debt structure, explores mortgage reduction strategies and determines possible ways that debt can be used for building your wealth.

Your Risk Plan seeks to understand the financial risks that you are exposed to. We first identify various risks and then look at ways that we can mitigate those risks through the use of expert risk reduction strategies.

Your Retirement Plan answers that fundamental question; “if you want to retire at a certain age, with a given income stream, how much money will you need and are you on track?”

We then work with you to plan to achieve the retirement lifestyle you desire.

Your Estate Plan assists you to identify and articulate your wishes in the event of your untimely death and determines strategies that plan to provide for your surviving family to get the right assets to the right people at the right time.